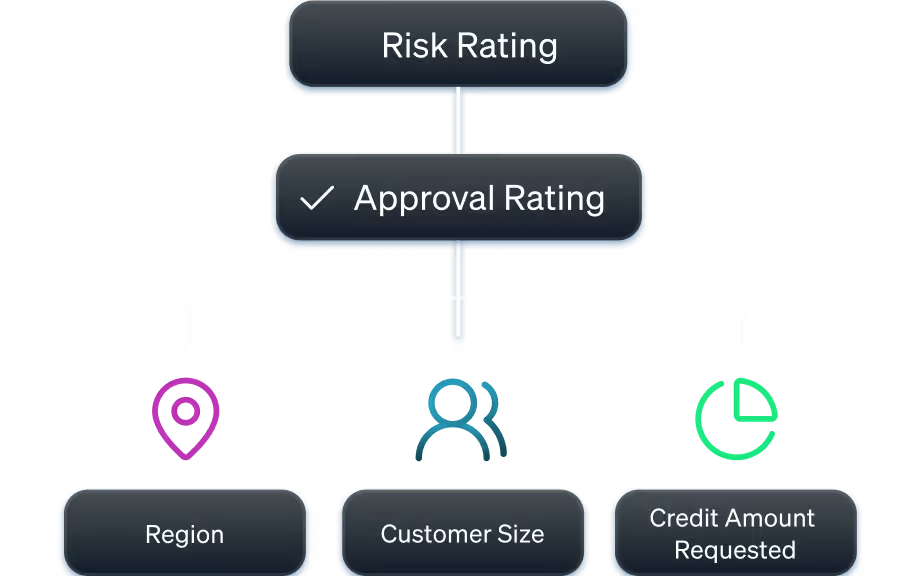

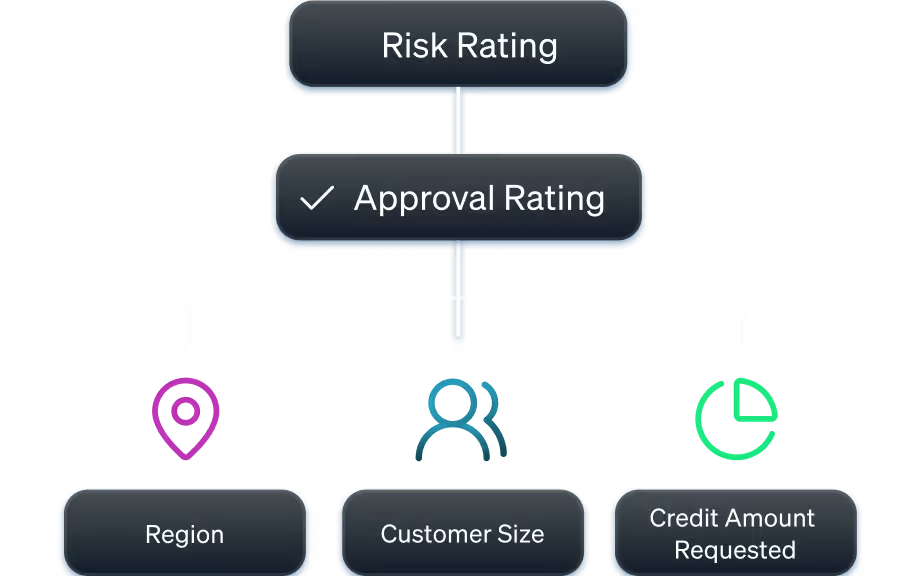

Score With Structure

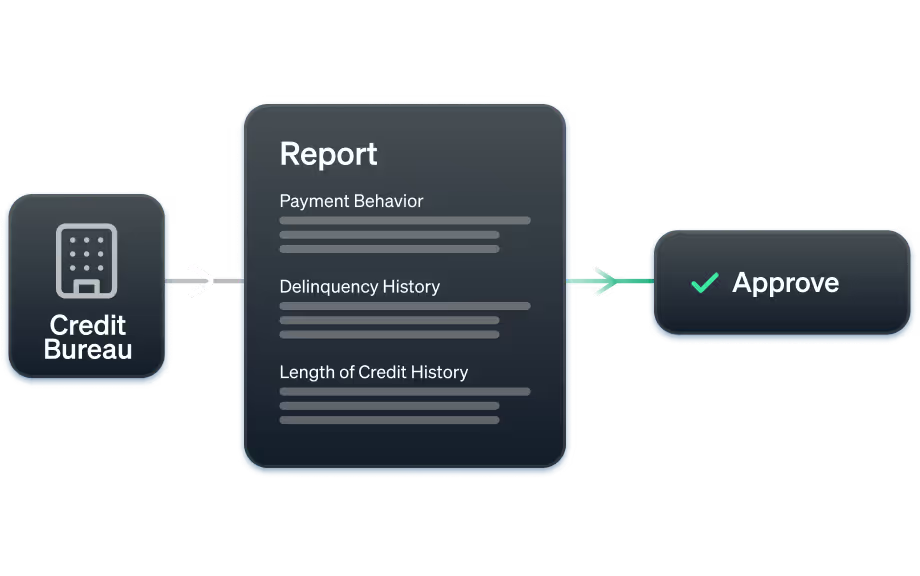

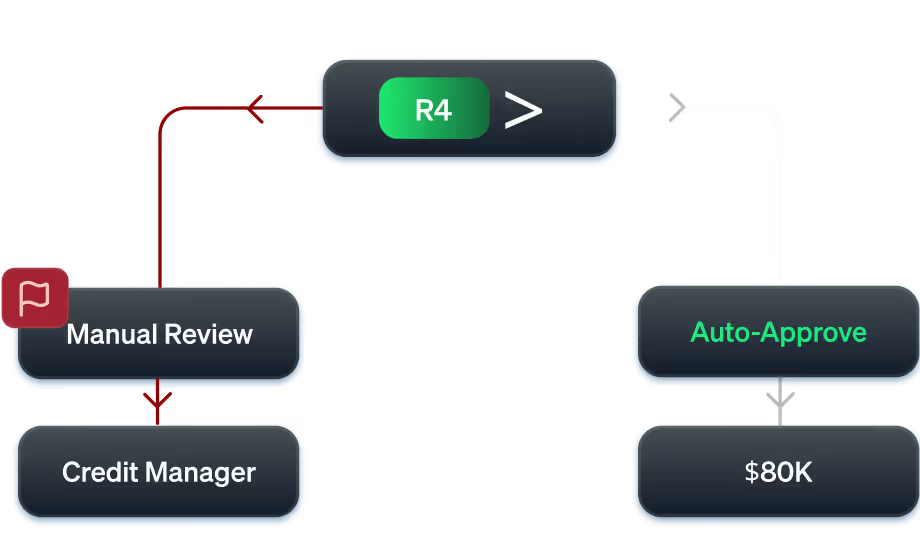

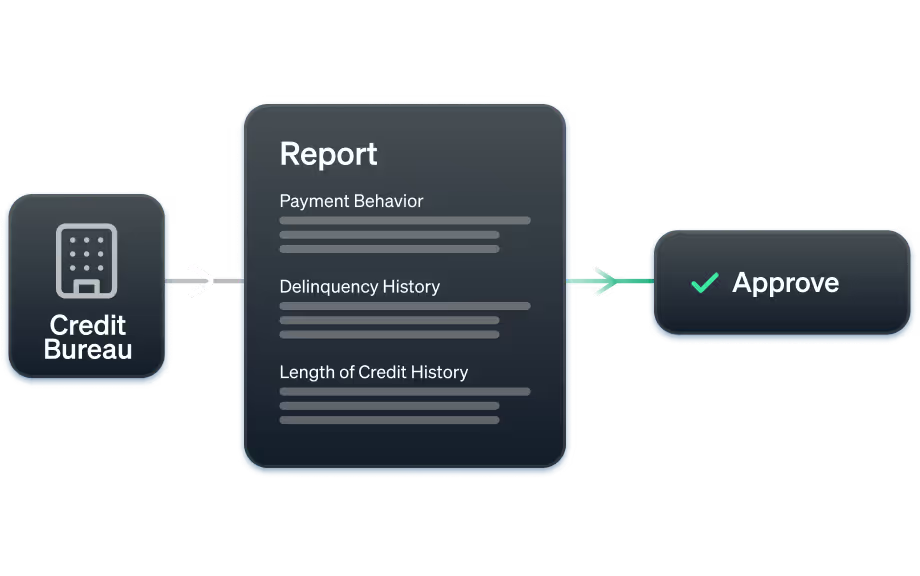

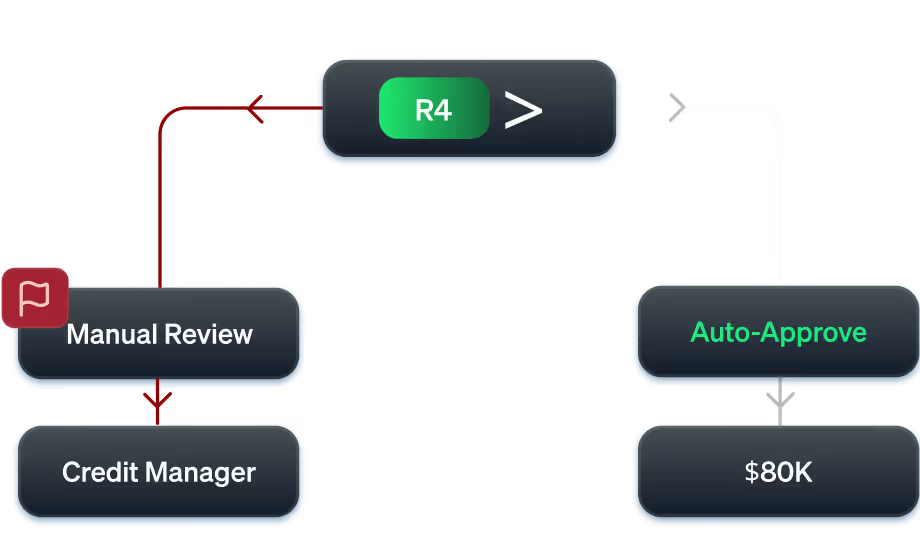

Automate the Approval Path

Monitor Risk as it Evolves

Exception Handling and Collaboration

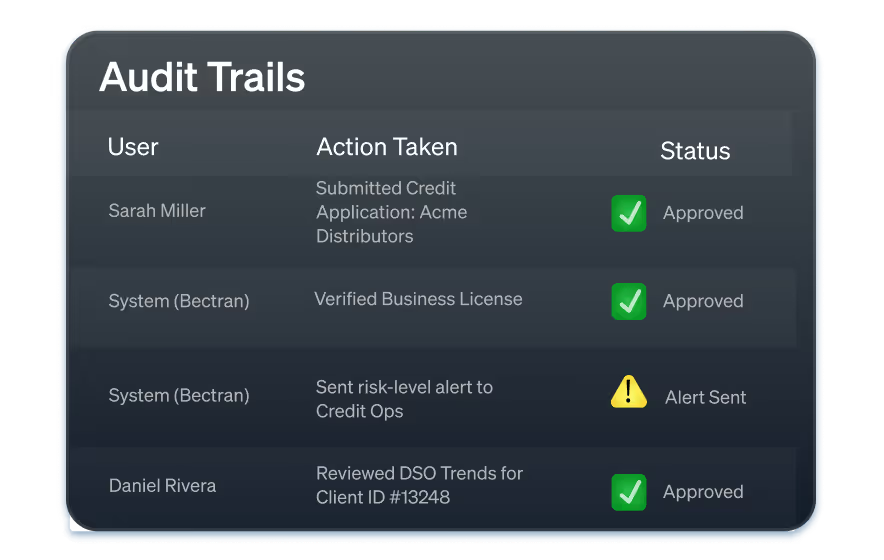

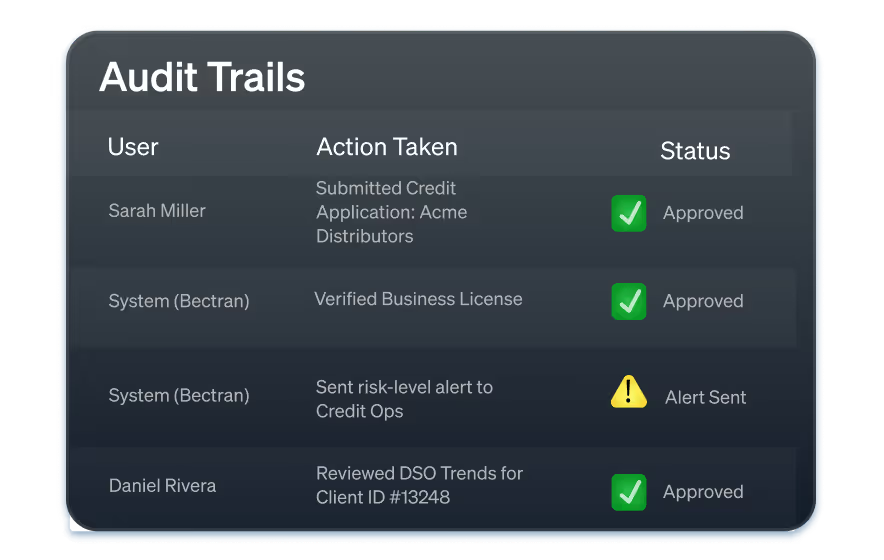

Scale Confidently with Built-In Compliance

Upgrade How Credit Gets Done

Lower

drop-off rate

Faster application

turnaround

Job sheet

automation

Organize the chaos into one cohesive platform

Enhance customer experience with a self-service portal

Monitor Days Sales Outstanding trends

Automated Trade Reference Network

Visualize revenue growth from credit decisions

"We collect money faster. Compared to last year, we're $10 million ahead, which is substantial in our business."

"It's been a very positive experience. Not only with implementation, but with custom modifications or changes down the road... we have a very good partner in Bectran that listens to and understands our needs."

"Bectran uses advanced logic to connect with our customers and give them more information...[Bectran] has been quicker and easier for our customers."

"The technical team met with us on multiple occasions. They made time available, even during our working hours, in order to implement the solution."

"We're not a cookie-cutter credit department... we were very impressed with how Bectran stuck with us, even with the curveballs we threw."